Reproduced with permission from Tax Management International Tax Monitor, 99 ITM, 5/24/17. Copyright 2017 by The Bureau of National Affairs, Inc. (800-372-1033) <https://www.bna.com>

By Jan Stojaspal

Snapshot

- Companies advised to verify business reasons behind past restructurings

- Focus on companies using goodwill to erect tax shields

A new warning from Poland's finance ministry means that companies pursuing restructuring will need to take extra care to make sure the move has sufficient economic basis, local tax professionals say.

The May 22 warning—the second of its kind this month—also has broader implications as it is evidence of the government stepping up efforts to improve tax collection by wielding a 2016 general anti-avoidance rule (GAAR), according to tax professionals.

Poland's finance ministry cautioned in the new warning against using enterprise transformations for aggressive tax planning.

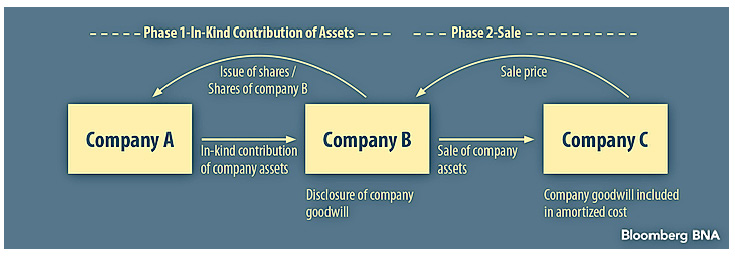

The ministry highlighted the specific scenario of two companies using an intermediary company to create a reduction in income taxes, also known as a tax shield, via company goodwill (see graphic below).

According to Piotr Wyrwa, a tax consultant with RSM Poland, the goodwill is created when the first of the two companies makes an in-kind contribution of either an enterprise or an organized part of an enterprise to the intermediary in exchange for the intermediary's shares.

Subsequently, the goodwill is transformed into an allowable deduction from taxable income when the intermediary company turns around and sells the acquired assets, including the goodwill, to the second company, he added.

"The main benefit of the structure is an opportunity to create the so-called tax shield for the second company, Wyrwa told Bloomberg BNA in a May 25 telephone interview. "The company obtains an enterprise under a sales agreement, which, unlike in the case of an in-kind contribution, enables the amortization (depreciation) of all its components, including goodwill."

"In other words, the company may reduce its future income generated—for example on operating activities—by tax-deductible write-offs," he added.

Ministry to Follow Up

According to a spokesman for Poland's finance ministry, aggressive tax planning described in the May 22 warning has been in use since 2012 and its use was "increasing in frequency" until 2016, when the GAAR was introduced.

He added that the ministry plans to follow the warning with a general tax interpretation explaining what constitutes tax deductible costs in the event of sale of an enterprise that was acquired via in-kind contribution. The interpretation "should be issued within next 3-4 weeks," he wrote in a May 26 email.

The finance ministry's earlier May 8 warning spotlighted the instance of a closed-end mutual fund trying to avoid paying tax on income from a tax-transparent partnership by way of a bond issue, which made it possible to shift the fund's stake in the partnership to a special purpose vehicle and to declare the vehicle's revenue as bond income, which is tax exempt.

Advice for Companies

"This is only the beginning," Rafal Szczotka, a tax director specializing in mergers and acquisitions for PwC Poland, told Bloomberg BNA. "Much will depend on how the general anti-avoidance rule will be used by the tax authorities."

His advice is to leave nothing to chance, considering how new GAAR is to Poland and that the tax authorities and courts may, at least in the near-term, have a hard time comprehending the various business reasons that drive enterprise transformations.

"It is in your interest to make those things very clear to them, to really cooperate with them, to make sure they understand," he said. "Otherwise, you will lose the case because the main dispute point is around answering the question why you did it, not about what the [tax] regulation looked like."

"In the situation when somebody did a restructuring, and they don't feel they have a strong business basis for this, they should consider, for instance, whether for the periods after introducing the general anti-avoidance rule to simply make a correction to avoid a very long dispute with a really uncertain outcome," he added.

This is what Poland-based footwear manufacturer Warsaw Stock Exchange-listed CCC SA did, when it announced May 25 that it was suspending amortization of goodwill it disclosed in connection with a trademark transfer during a 2014-2015 restructuring.

As far as the May 25 announcement is concerned, "directly it's not related" to the May 22 warning, "but it's a similar case," Bartlomiej Piekarski, CCC's investor relations manager, told Bloomberg BNA in a May 26 telephone interview. If the restructuring "happened now, it would be challenged," he added.

Review Transactions

Wyrwa also advised companies to exercise due care.

"I recommend to all taxpayers who performed similar transactions to review them and see if they are justifiable from a business, economic point of view," he said.

Caution is even more important with GAAR on the books, he added.

Prior to GAAR, tax optimizations "were risky, but the risk concerned mainly interpretation of tax law," he said. "Now when you have the anti-avoidance clause, the discussion is no longer about how to interpret a certain tax provision but whether there is business substance to a particular structure. ... The risk has increased, and the anti-avoidance clause is a new weapon that makes it possible for the tax authorities to judge transactions from a business, economic point of view, rather than just legal."

Aggressive Tax Planning Conditions

The specific scenario described in the May 22 warning qualifies as aggressive tax planning only when certain conditions are met.

According to Wyrwa, the main conditions are:

- Transfer of assets happens in two separate transactions without economic justification.

- Intermediaries are involved.

- Two separate transactions are executed in close succession.

- Transactions take place between closely affiliated companies.

- Cash transfers are absent between companies.

According to Szczotka, these types of transactions are not sector-specific.

"I saw such transactions in many sectors," he said. "The common characteristic of this scheme is that it was applied in any case where there was a huge goodwill inside a business, and this may be a case in many businesses basically."

To contact the reporter on this story: Jan Stojaspal in Prague at correspondents@bna.com

To contact the editor responsible for this story: Penny Sukhraj at psukhraj@bna.com