Zuzanna WOJCIECHOWSKA

Audit Assistant at RSM Poland

During the year a number of economic events take place in a company, affecting the overall image of the entity. Not always, however, do those events have the same impact on the entity's results presented in accordance with the tax law and the balance sheet law. The discrepancies between the tax and balance sheet system are caused by different principles, functions and different methods of valuation of assets and liabilities components, which, consequently, leads to temporary positive and negative differences between the values stipulated in the financial statement and those that would be calculated and presented on the basis of the tax law. The best way to identify those differences would be to compare the accounting and the tax balance sheet[1], and then determine whether the differences are permanent or only temporary, on which the assets and provisions for deferred income tax are created. Creating assets and provisions for deferred income tax lead to the creation of the deferred income tax presented in the company's financial results. In my post today, I will briefly describe the issue of deferred taxes created on the basis of a tax loss.

What is a tax loss?

If tax costs are higher than the tax income, a tax loss occurs. The tax loss can be settled over the next five fiscal years. In a fiscal year, a given loss can be settled up to fifty percent, which means that the tax loss can be settled in no less than two years. If in the five-year period the loss is not settled, then the taxpayer loses the possibility of its settlement. In the same way as in the case of negative temporary differences, in relation to a tax loss, assets due to deferred income tax are created if the entity is able to prove that in the coming years it will reach sufficient taxable income to deduct the activated tax losses from it. In the balance sheet account, in the item concerning the assets due to deferred income tax, the increase is indicated on the Debit (dr) side, and the decrease - on the Credit (cr) side.

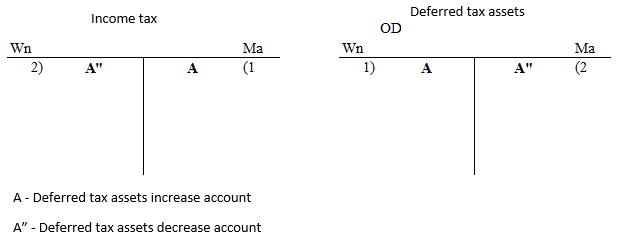

Figure 1. Register of increases and decreases of the assets due to deferred income tax.

The first operation is a consequence of the tax loss incurred by the company as a result of which the entity may create assets due to deferred income tax. A given operation (increasing the assets due to deferred income tax) reduces the value of income taxes stipulated in the income statement (accrued deferred tax assets are recognised on the Credit (cr) side of the income tax nominal account). In the case of a tax loss that is possible to be settled, the assets due to deferred income tax are decreased (A"). Released assets due to deferred income tax increase the balance sheet tax.

How to settle a tax loss?

Activating a loss involves the creation of deferred tax assets in the amount of the product of the loss and the income tax rate projected for the period in which the loss will be settled. The commonly called "activated loss" (i.e. deferred tax assets created from a tax loss) is a component of the assets controlled by the entity, and when creating it, due diligence and carefulness are required. The entity must not create it if the company is not certain that the settlement of the tax loss will take place. The "activated loss" may be indicated only for the part as to which there is a probability of its settlement. The factor that may increase the likelihood that the loss will be settled is the presence in the enterprise of a number of temporary differences which, as a result of the future implementation, will increase the basis for calculating the income tax. Therefore, it needs to be considered each time whether there is a chance that the company within five fiscal years will obtain sufficient tax revenue to settle the loss. These considerations are based on the Polish tax and balance sheet system, but also international regulations[2] allow the possibility to create assets due to tax loss. The profits are recognised by the entity as deferred tax assets in the period in which the tax loss occurred. It is associated with the prima facie evidence of their achievement and determining their value in a reliable way. When analysing the probability of settling a tax loss, you should think about the reason for its occurrence. A loss arising in connection with a single-time incident identified by the entity should not occur again, and, as a consequence, the likelihood of achieving taxable income in the next period is high. Significant positive temporary differences that will result in the emergence of future taxable amounts and the possibility of tax planning also increase the likelihood of settling the tax loss before the expiration of the right to settle it. Activating a tax loss is an important issue from the perspective of an entity incurring losses. Therefore, you should think it over carefully and at the end of each period carry out a detailed assessment of unrecognised assets due to deferred income tax.

[1]We have already discussed the differences in the accounting and tax law and various amounts stipulated in the accounting balance sheet and balance sheet for tax purposes on our blog in the article entitled: Accounting, group and tax balance sheets - or what robs accountants of their sleep and how to change it.

[2] International Accounting Standard / IAS 12 (London, 2016, Sections 14, 34-36).